- Why BAAR?

BAAR Technologies transforms Identity Security and IT controls testing

Automate Identity Governance and Administration and Continuous Monitoring of IT controls.

Products and platforms

Research & Innovation

Our innovation lab is a dynamic hub where we brainstorm, research, prototype, and test groundbreaking ideas and technologies. It fuels our mission to create pioneering solutions that drive industry advancement. - Identity

Identity

- Customer Access Management

- Single Sign on

- Multifactor Authentication

- Passwordless Access

- Identity Federation

- Access Control

- Privileged Access Management

Customer Access Management

BAAR-IGA provides efficient and secure access control mechanisms for external users, ensuring seamless and controlled access to company resources and ultimately improving security and user experience.

Workflows can also be set up to manage the customer onboarding and off-boarding processes to automate them.

Single Sign-On (SSO)

BAAR-IGA enables users to access multiple applications with one set of credentials, simplifying login processes and enhancing user experience in workforce identity management.

This solution can also be applied to legacy applications with no change to the application.

Multifactor Authentication

BAAR-IGA can add Multifactor Authentication (MFA), including biometric validation, to new age and legacy applications. This security measure requires users to provide two or more forms of identification before granting access to a system or application, adding an extra layer of protection beyond just passwords.

Passwordless Access

BAAR-IGA can provide Passwordless Access to new-age as well as legacy applications. This eliminates the need for traditional passwords, relying instead on alternative factors such as biometrics, hardware tokens, or mobile authentication apps. This approach simplifies the authentication process while bolstering security, offering a seamless and secure way for users to access systems and data.

Identity Federation

BAAR-IGA offers a centralized authentication mechanism that allows users to access multiple applications and systems using a single set of credentials. It enables seamless and secure access management by establishing trust relationships between identity providers and service providers, facilitating the exchange of authentication and authorization information.

Access Control

BAAR-IGA systematically regulates who can access or use corporate resources, determining entry and usage rights within an organization. In workforce identity, it verifies and grants employee credentials to ensure operational integrity and data security.

Privileged Access Management

BAAR-IGA enhances security for privileged users by restricting access to critical systems and data, mitigating the risk of unauthorized use and potential breaches, ultimately safeguarding sensitive information and maintaining data integrity.

Passwordless privileged access and rotation of credentials after each time a privileged user accesses a system reduces risk.

- Governance

Governance

- User Access Review

- Segregation of Duties

- Policies Management

- Risk Profiling

- Audit and Compliance

- Access Anomaly Monitoring

- Automated Control Testing

User Access Review

BAAR-IGA simplifies the process of User Access Reviews for all systems (New age, legacy, On-prem, cloud). User Access Reviews in BAAR-IGA are of the following types:

- Adhoc

- Scheduled

- Anomaly Based

- Transfer Based

User Access Reviews maintain security and compliance and minimize risks by regularly verifying and adjusting user permissions and protecting sensitive data.

Segregation Of Duties

BAAR-IGA continuously monitors for Segregation of Duties (SoD) conflicts. SoD management covers the following:

- Inter Application

- Intra Application

- Source Code and Production

- Application Tier

Segregation of Duties prevents conflicts of interest, fraud, and errors by dividing tasks, enhancing accountability, and ensuring operational integrity.

Policies Management

BAAR-IGA manages your identity and access policies continuously and fully automated. Examples of policies are:

- Active Directory Dormancy

- Active Directory Password Expiry

- Active Directory Account Renewal (for temp workforce)

- Notice Period

- Application Dormancy

- Statutory Leave

Automated access management policies streamline security, improve efficiency, and reduce human error by enforcing consistent and timely access controls.

Risk Profiling

BAAR-IGA’s AI assigns a risk score to users using the following attributes:

- By Type of Data the user has access to

- By Type of Applications the user has access to

- By the location the users accesses the network

- By number of password resets

Automated risk profiling proactively identifies and mitigates security threats, safeguards sensitive data, and maintains regulatory compliance effectively.

Audit and Compliance

BAAR-IGA automates access controls, auditing, and compliance reporting, ensuring transparency, accountability, and adherence to regulatory requirements.

Access Anomaly Monitoring

BAAR-IGA continuously monitors your systems for inappropriate access any users may have. Some examples are as follows:

- More access than needed

- Backdoor users

- Terminated users with access

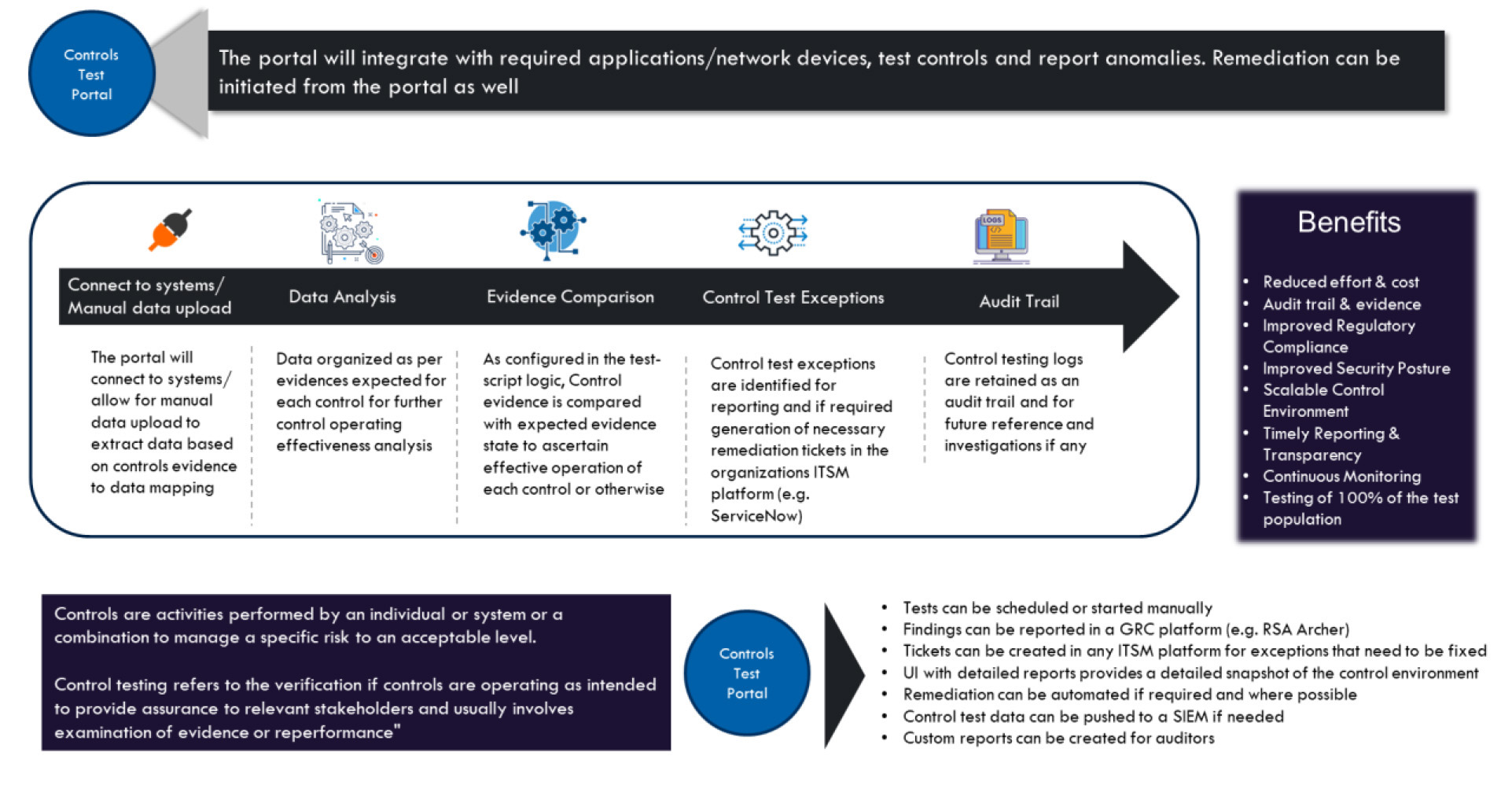

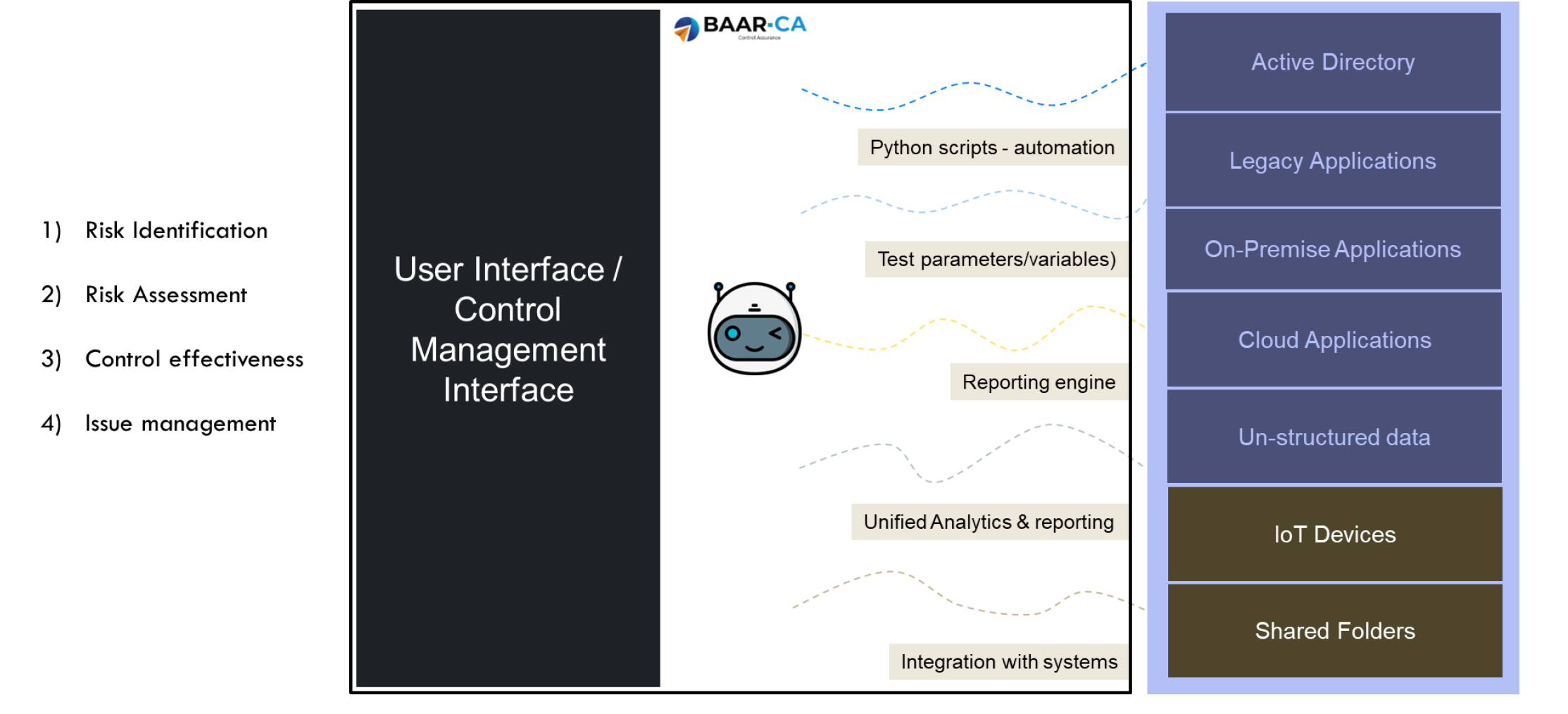

Automated Control Testing

BAAR-IGA self-tests and continuously monitors logical access controls before an internal or external audit (SOC, SOX), ensuring the operational effectiveness of the controls. Automated control testing increases efficiency, accuracy, and compliance while reducing human error, providing robust security and regulatory adherence.

- Administration

Administration

- Identity Lifecycle Management

- Access Lifecycle Management

- Automated Access Revocation

- Transfer Access Management

- Centralized Identity Violations

- Self Serve Portal

Identity Lifecycle Management

BAAR-IGA manages the entire identity Lifecycle in a fully automated manner. This includes the following:

- Onboarding

- Offboarding

- Transfers

- Amendment

- Reactivation

Automating the identity lifecycle mitigates risks, saves time, enhances audit outcomes, improves onboarding processes, and reduces IT operational costs. The benefits are immediate and extensive.

Access Lifecycle Management

BAAR-IGA automates provisioning, modification and de-provisioning of access based on a birthright for Applications (Legacy, On-prem, and Cloud), Network folders, SharePoint folders, Databases, Switches, Firewalls and more.

Access Lifecycle Management optimizes user access provisioning, modification, and de-provisioning, bolstering security, compliance, and resource utilization across organizations.Automated Access Revocation

BAAR-IGA automatically revokes access or changes user roles based on the outcomes of user access reviews.

Automated access revocation post-user review enhances security, mitigates risks, ensures compliance, and minimizes unauthorized access, fostering robust data protection.

Transfer Access Management

BAAR -IGA automates access provisioning, modifying and de-provisioning when a user is transferred within the organization.

Transfer Access Management ensures seamless user transitions within organizations, maintaining data security, minimizing disruptions, and preserving productivity.

Centralized Identity Violations

BAAR-IGA finds violations for an identity across multiple security systems like: Privileged Access Management, User Behavior Analytics, Security Information and Event Management (SIEM), Data Loss Prevention (DLP) Systems, Endpoint Security Solutions and more.

Centralizing identity violations from all monitoring tools provides a unified view, streamlines response, enhances security and simplifies compliance reporting.

Self Serve Portal

BAAR-IGA allows users to self serve for the below activities. Approval and process workflows can be customized:

- Password Resets (AD and Applications)

- Request System Access

- Request a Role Change

- Delegate Access

The Self-Service Portal empowers users to manage their access, reducing administrative burden, improving efficiency, and enhancing user experience.

- Resources

- About Us

Our Story

BAAR combines the power of AI and automated workflow to deliver secure and sustainable Identity Management Solutions.

About Us

Are You Ready to Secure and Automate Your Identities and Controls?