Streamline and automate the process of assessing, monitoring, and managing compliance within your organization’s IT environment.

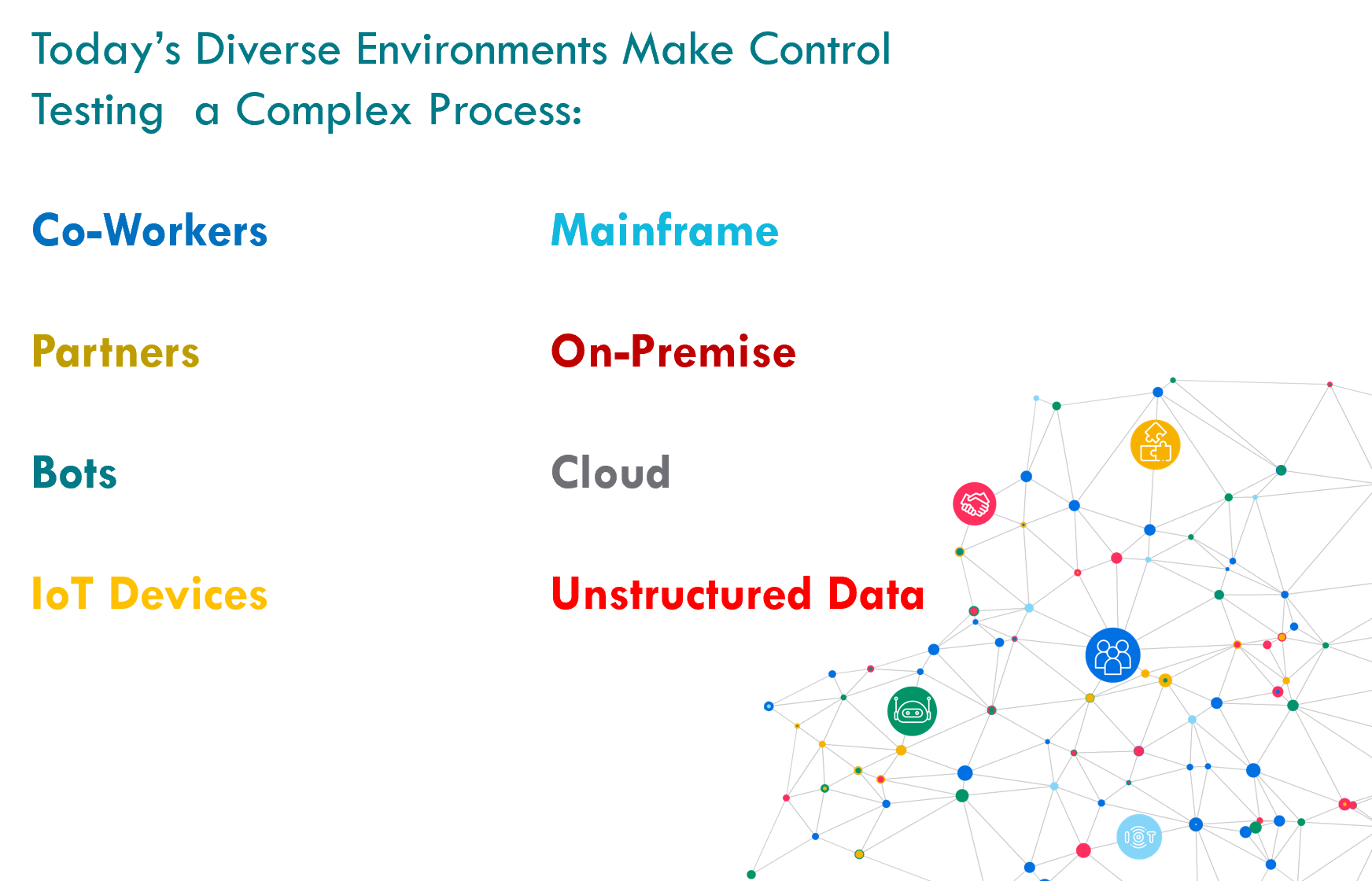

As organizations race ahead with their digital transformation endeavor, visibility, control and compliance becomes more vital as well as complex because of the following key reasons:

1. Limited resource bandwidth

2. Laborious processing and information gathering

3. Competing business priorities

4. Distributed data

5. Technological diversity within environments

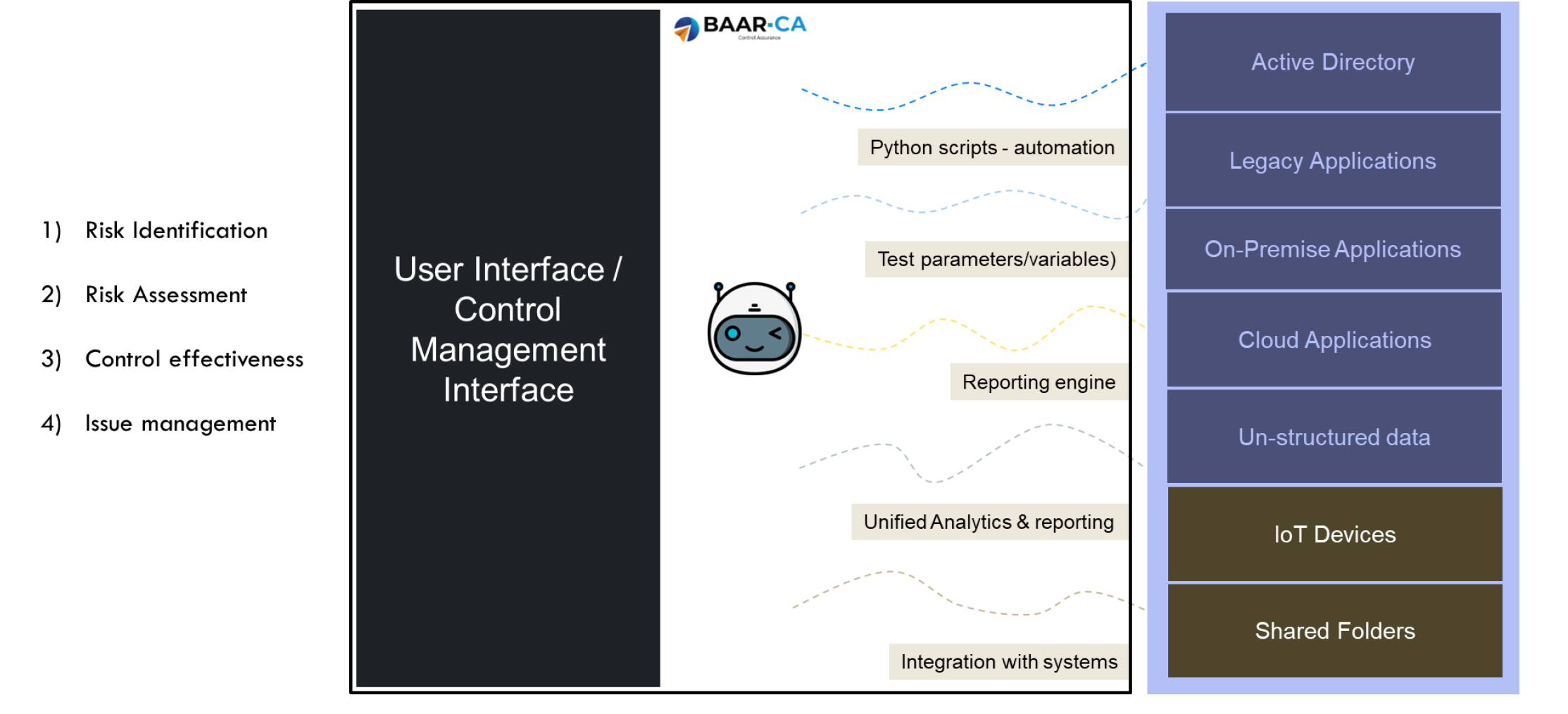

BAAR-CA Streamlines and automates the process of assessing, monitoring, and managing controls within your organization’s IT environment.

BAAR-CA facilitates the assessment of controls by providing standardized frameworks, templates, and workflows for evaluating the effectiveness of various security controls, policies, and procedures.

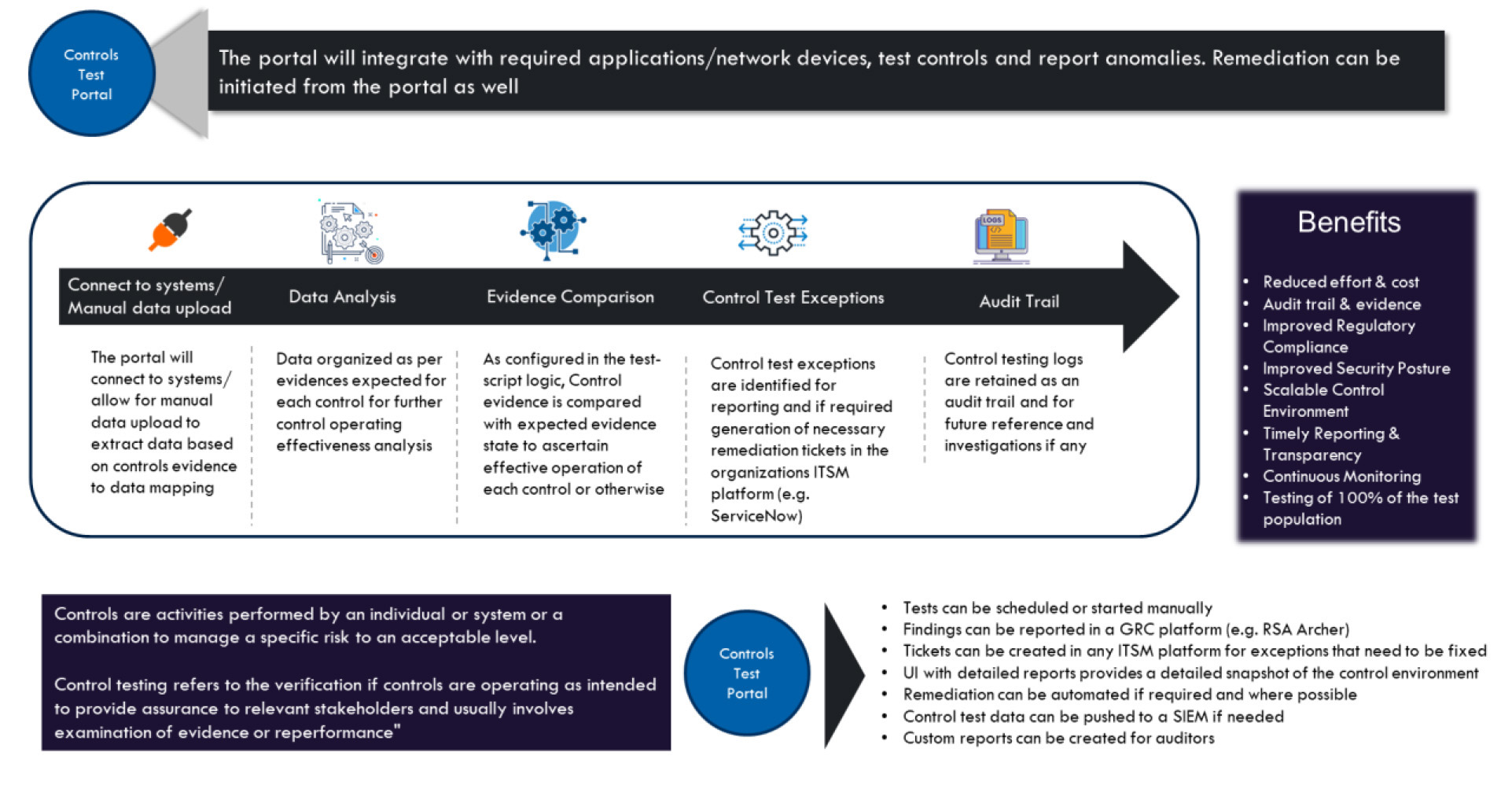

BAAR-CA automates the testing of operational effectiveness of controls by executing predefined tests, scripts, or simulations to validate compliance with regulatory requirements, industry standards, and internal policies.

BAAR-CA tracks and manages control deficiencies and remediation activities by assigning tasks, tracking progress, and escalating issues to appropriate stakeholders for resolution.

BAAR-CA provides real-time monitoring and reporting capabilities to track the status of controls, monitor changes in control environments, and generate audit-ready reports for stakeholders.

BAAR-CAsupports compliance efforts by mapping controls to regulatory requirements, automating compliance assessments, and generating evidence of compliance for audits and regulatory reporting.

Enhanced visibility, standardization, and automation of control processes improved governance, accountability, and transparency across the organization.

Automation of control assessments and workflows reduced manual effort, accelerated assessment cycles, and improved overall efficiency.

Risk-based prioritization and real-time monitoring of controls enabled proactive risk management and mitigation, reducing exposure to operational and compliance risks.

Streamlined control assurance processes and centralized documentation facilitated compliance with regulatory requirements and audit mandates.

Reduced administrative overhead, manual errors, and audit preparation time led to cost savings and resource optimization.

Stakeholders, including management, auditors, and regulators, benefited from improved control visibility, accuracy, and reporting, enhancing stakeholder confidence and satisfaction.

Case Study: A Leading Bank in Canada Implemented BAAR-CA for Enhanced Governance and Compliance

A leading bank in Canada, faced challenges in managing and assessing its internal controls across various business units and IT systems. To address these challenges and strengthen its control environment, the bank implemented BAAR-CA.

Complex Control Landscape: The Bank had a diverse range of controls spread across multiple departments, processes, and IT systems, leading to complexity in control management and assessment.

Manual Processes: Control assessments were predominantly manual, involving spreadsheets, emails, and disparate tools, resulting in inefficiencies, errors, and lack of real-time visibility.

Regulatory Requirements: Compliance with regulatory mandates such as ISO27001, SOX, and SOC necessitated a robust control assurance framework and evidence of control effectiveness.

Audit Preparedness: Preparation for internal and external audits required extensive documentation, evidence gathering, and coordination among stakeholders, posing challenges in meeting audit timelines and requirements.

The Bank deployed BAAR-CA to automate and streamline control management, assessment, and monitoring processes across the organization.

Centralized Control Repository: A centralized repository for storing and managing control frameworks, policies, procedures, and related documentation to ensure consistency and standardization.

Automated Control Assessments: Automated workflows, templates, and tools for conducting control assessments, testing, and evidence collection, reducing manual effort and ensuring accuracy.

Risk-Based Prioritization: Risk-based prioritization of controls and assessments based on the likelihood and impact of control failures, enabling focus on high-risk areas.

Continous Monitoring: Real-time monitoring and dashboards for tracking control status, issues, and remediation activities, providing stakeholders with visibility into control effectiveness and compliance posture.

Integration with IT Systems: Integration with core banking systems, ERP platforms, and other IT systems to collect control data, automate testing, and synchronize control information across the organization.

Audit Trail and Reporting: Comprehensive audit trails, logs, and reports for documenting control activities, changes, and audit findings, facilitating audit readiness and compliance reporting.

By implementing BAAR-CA, the Bank transformed its control management and assurance practices, strengthening governance, mitigating risks, and achieving regulatory compliance. BAAR-CA’s automation, integration, and reporting capabilities positioned the bank for sustained growth, resilience, and success in the highly regulated banking industry.

© 2017 – 2024 BAAR Technologies. All rights reserved.

We use cookies to ensure you get the best experience on the BAAR Technologies website, to help us understand our marketing efforts, and to reach potential customers across the web. You can learn more by viewing our privacy policy.